Do you think your insurer has you covered for asbestos? Think again.

Does your business involve the repair or renovation of buildings constructed prior to 1990, or provide trade services to older buildings – or does your business subcontracts asbestos removal? There’s a chance that you are liable for legal claims made against you from the life-threatening damage caused by asbestos.

There’s also the chance that your insurer isn’t covering you for such claims.

This is because many insurance policies being sold in the market have specific exclusions for asbestos claims. This is something you must be wary of, even if your core business isn’t related to building renovation. As hinted above, even hiring a

subcontractor to remove asbestos from your premises or providing certain services to older properties, may expose you to

liability.

What is asbestos?

Asbestos is a naturally occurring mineral composed of thin, microscopic fibres. Because of its resistance to fire and extreme temperatures, it was commonly used in building products all up to the late 80s.

It was discovered, however, that asbestos was linked to cancers of the ovary, larynx and lungs, and according to

asbestossafety.gov.au, contributes to approximately 4000 deaths in Australia per year.

What are your responsibilities with asbestos as a business?

If you are involved with the repair, maintenance or renovation of buildings constructed prior to 1990, you are responsible for the health and wellbeing of anyone at risk of asbestos exposure in these premises.

You should also be conscious of any tradespersons or contractors carrying out work on these buildings. They must be properly licensed, comply with work and safety laws and should be adequately insured.

Even clients who subcontract asbestos work need to be qualified and accredited to be able to obtain cover from many insurers in today’s market. Please contact us for specific advice for your particular circumstance.

According to asbestossafety.com.au, “You have legal responsibilities under common law, public health law and environmental protection law to protect the health of others as well as yourself and your family. This means that you must take all necessary precautions to prevent or minimise exposure to asbestos fibres.”

Voluntary Workers Insurance. Get protection in minutes.

Protection for when the unexpected happens

Management Liability insurance is designed to provide protection to both the business and its directors or officers for claims of wrongful acts in the management of the business.

Public Liability insurance is there to provide protection if someone makes a claim against the insured, the business or its employees.

According to asbestossafety.com.au, “You have legal responsibilities under common law, public health law and environmental protection law to protect the health of others as well as yourself and your family. This means that you must take all necessary precautions to prevent or minimise exposure to asbestos fibres.”

What could happen if you’re not adequately covered?

You may be held liable for any injuries and/or losses of life incurred from the inhalation of asbestos.

A lot of asbestos-related claims we see particularly come from ceilings: from electricians and roofing contractors who accidentally put their foot through ceilings that are asbestos whilst in the roof cavity. This results in asbestos fibres going throughout the

property and contaminating the

contents of the building.

In such an instance, not only will you be faced with the expensive asbestos clean up and repair costs to the ceiling, but there are also the contaminated contents, which usually ends up needing to be thrown out and replaced.

Another situation to think about is where you subcontract any asbestos related activities out to insured third party companies. Although your

business may not be conducting these activities, you are billing your customer for these services. Any

claims that may arise in these cases would usually be address to your company, as your business is the only name your customer knows is involved.

You then need to defend such claims and request the claim be redirected to the subcontracted company (where possible).

What insurance cover is available?

As mentioned above, many existing policies specifically exclude asbestos claims such as bodily injury/death arising from, or in connection with, asbestos.

Further, there are a number of government schemes/facilities for asbestos-related bodily injury/illness/death claims, but each state is different and the set ups may vary considerably.

To find out how to be adequately insured for asbestos, it is useful to speak to a qualified, experienced business insurance broker (like

us!) who can help you find a cost-effective solution to your particular situation.

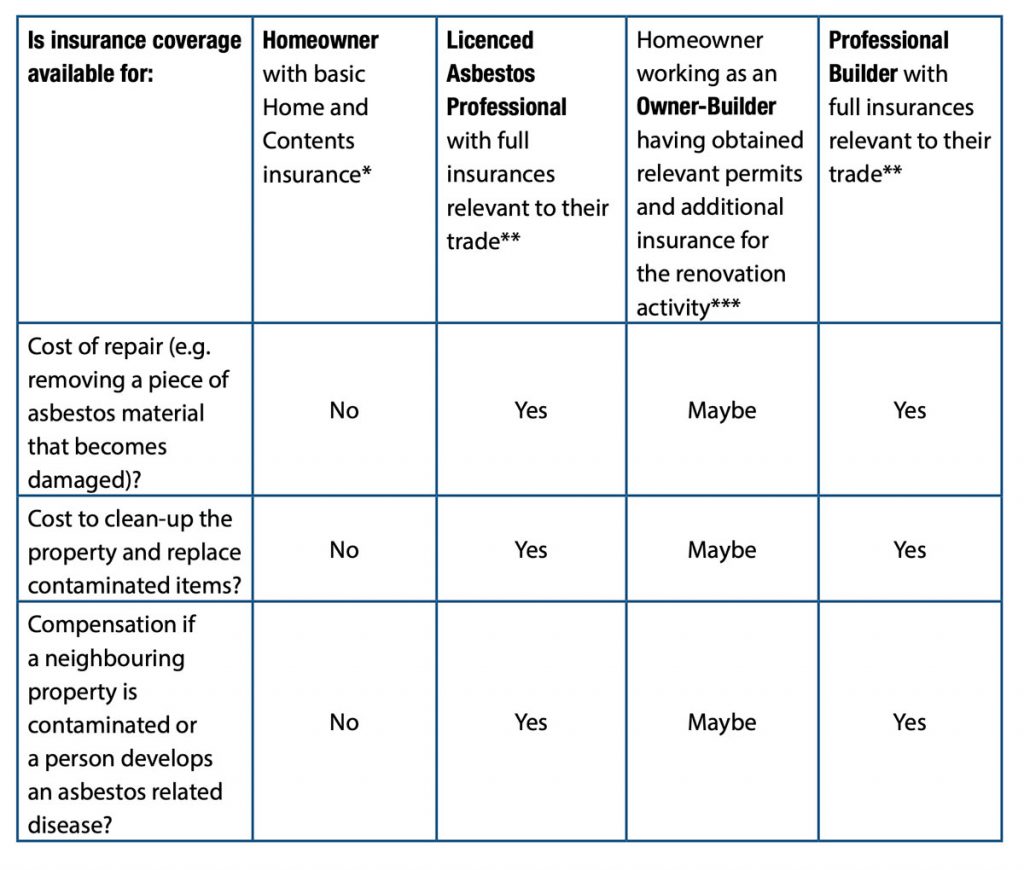

Asbestossafety.org.au has provided examples of renovation scenarios that could lead to asbestos exposures, their financial risks and whether insurance is likely to provide coverage.

What should you do to minimise your risks?

- Be aware that if the building was constructed before 1990, there is a high risk of asbestos contamination

- Understand your legal obligations when it comes to asbestos contamination prevention

- Understand that you may be liable for the actions of any contractors/subcontractors working on the premises

- Ensure that any contractors/subcontractors are fully licensed, qualified to work with asbestos and adequately insured

Most importantly, before you work with or in any property that may have asbestos, speak to a qualified business insurance broker who can help you include the appropriate asbestos wordings in your insurance policies.