As a business owner, you understand the importance of protecting your business from potential risks and liabilities. One of the key steps in securing comprehensive insurance coverage for your business is finding the right business insurance broker. A knowledgeable and trustworthy broker can guide you through the complex world of business insurance, helping you navigate policies and find the best coverage for your specific needs. In this blog post, we’ll discuss the essential factors to consider when choosing a

business insurance broker.

Expertise and Industry Knowledge

When selecting a business insurance broker, finding someone with expertise and in-depth knowledge of the insurance industry is crucial. Look for business insurance brokers with experience working with companies in your specific industry. A broker who understands your business’s unique risks can provide tailored advice and ensure you have adequate coverage.

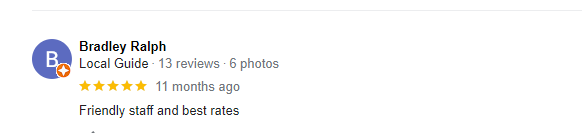

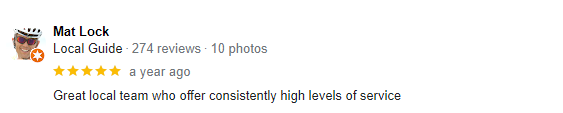

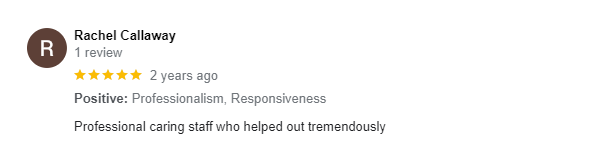

Reputation and Track Record

Research potential insurance brokers’ reputations and track records. Seek out referrals and read online reviews or testimonials from other businesses that have worked with them. A broker with a solid reputation indicates reliability, professionalism, and a history of delivering satisfactory services to their clients.

Strong Insurer Relationships

A reputable business insurance broker should have strong relationships with multiple insurers. This allows them to access a wide range of insurance products and find the most suitable policies for your business. Brokers with established carrier relationships can also negotiate better terms and pricing on your behalf, saving you time and money.

Management Liability insurance is designed to provide protection to both the business and its directors or officers for claims of wrongful acts in the management of the business.

A business insurance pack can provide cover for your business premises and contents, against loss, damage, theft or financial loss from an insured interruption to the business.

Purchase up to six products under one Business Insurance Package.

A reputable business insurance broker should have strong relationships with multiple insurers. This allows them to access a wide range of insurance products and find the most suitable policies for your business. Brokers with established carrier relationships can also negotiate better terms and pricing on your behalf, saving you time and money.

Customisation and Tailored Solutions

Every business has unique insurance needs, and a good broker understands this. Look for a broker who takes the time to assess your specific risks and provides customised insurance solutions to address them. Avoid brokers who use a one-size-fits-all approach and instead prioritise those who listen to your concerns and craft policies that meet your specific requirements.

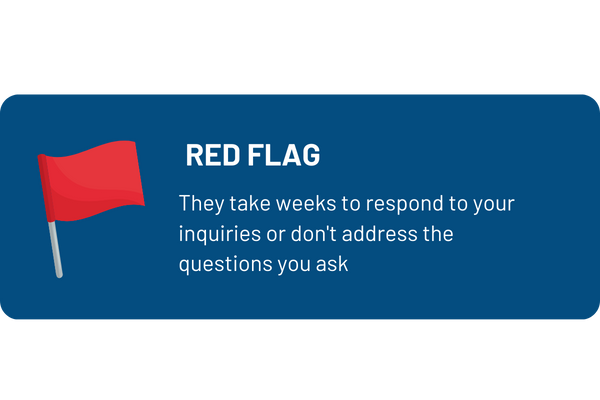

Excellent Communication and Responsiveness From your Business Insurance Broker

Open and transparent communication is essential when working with an insurance broker. Look for a broker who communicates clearly, explains complex insurance terms in a way you can understand, and promptly responds to your inquiries. They should be proactive in keeping you informed about policy updates, changes in the insurance landscape, and any potential gaps in coverage that may arise.

Claims Handling Expertise

The true value of an insurance policy lies in its claims-handling process. A reliable business insurance broker should have expertise in managing

claims effectively. Inquire about their claims management approach and ask for examples of successful claims they have handled in the past. A broker who can smoothly guide you through the claims process and advocate on your behalf is an invaluable asset to your business. In fact, in the

Vero SME Index Report, there was a 12% increase in client satisfaction during the claims process compared to the previous year. Having a competent and proactive business insurance broker can make a world of difference during a claim.

Ongoing Support and Service

Insurance needs can evolve as your business grows and changes. Look for a broker who provides ongoing support and service, not just during the initial policy setup. A proactive broker will regularly review your coverage, assess any emerging risks, and make necessary adjustments to ensure your business remains adequately protected.

Transparent Fee Structure

Understand the fee structure of the insurance broker before committing to their services. Brokers typically earn a commission from insurance carriers, but clearly understanding their compensation arrangements upfront is essential. Ensure the broker is transparent about their fees and any potential conflicts of interest.

In conclusion, choosing the right business insurance broker is a crucial decision that can significantly impact the protection and success of your business. By considering factors such as expertise, reputation, carrier relationships, customisation, communication, claims handling, ongoing support, and fee transparency, you can make an informed choice. Remember, a reliable and knowledgeable insurance broker will serve as your trusted advisor, guiding you through the complexities of business insurance and ensuring that your company is adequately protected from potential risks and liabilities.