Farming, whether grain, dairy or cattle, are businesses with their special set of operational, financial and legal risks that need to be managed.

Managing internal and external variables such as the weather, animals, production, manpower, loss/damage, and finances requires constant attention.

Having the right farm insurance that suits you will help you manage the financial risks, giving you peace of mind and security.

Like any business issue, incorrect insurance sums insured or lack of the correct cover can be found in farming. It’s estimated that a large percentage of businesses are underinsured or lack the correct insurance cover.

Having the right advice will enable you to make informed choices about the risks you want to retain or insure.

Key Farming Risks

Whether you’re a hobby or commercial farming operation, we understand that farming comes with its own set of risks that have to be managed and that are different from other businesses.

Specialised Farm Insurance is a key tool in managing the financial risks relating to:

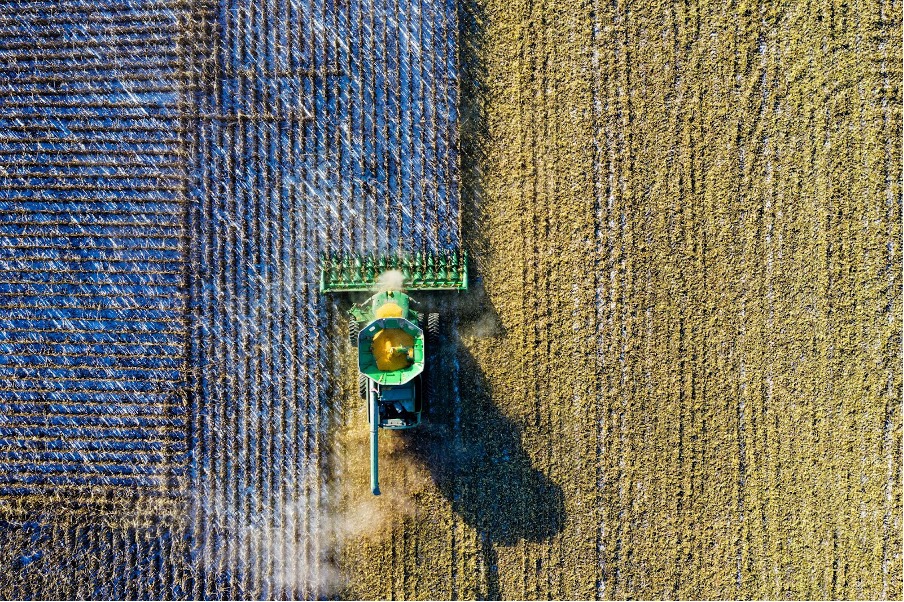

- Crops

- Livestock

- Property

- People

- Public and products liability

Farm Insurance Package

Farm insurance has been specially developed for farming risks. It is a combined package of eight different types of insurance that you can pick and choose to fit your own farm needs. As it is a package policy, it reduces administration by having one policy to deal with and understand, and it also provides a package discount.

In addition to the package policy, separate insurance policies are available for specialty lines such as crop, valuable stock, trade creditors, and aviation risks that are sold separately to the farm package.

Below is a summary of each of the sections in the package.

Home dwelling and contents insurance

This will cover your

home, building and

contents for various events, including accidental damage, fire, lightning, storm, or burglary.

Simple affordable public liability and material damage cover for commercial drone operators.

Cyber Liability Insurance is designed to help protect you from claims and support your profitability in the event of a cyber breach or attack.

Public Liability insurance is there to provide protection if someone makes a claim against the insured, the business or its employees.

This will cover your

home, building and

contents for various events, including accidental damage, fire, lightning, storm, or burglary.

Farm property insurance

This section covers accidental loss or damage to buildings, fencing, fixed plant and equipment, tanks, silos, and stockyards and any hay or grain in storage.

It also covers farming machinery such as tractors, sprayers and related trailers and implements.

Farm machinery insurance

The insurance will cover refrigeration units,

machinery, wind turbines, motors and pumps if they break down. It will cover the cost of repairs or replacing the machine or engine if not repairable. In addition, the cover can be extended to loss of stock due to the breakdown.

Motor vehicle insurance

This section covers utes, ATV's/quad bikes, motorbikes, sedans, harvesters and tractors for either comprehensive or third-party

property insurance.

Theft of farm property insurance

This insurance covers loss or damage related to the theft of farm property, including contents, plant and equipment, and machinery such as tractors, sprayers and related trailers and implements.

Livestock insurance

This insurance generally covers stock such as sheep or cattle up to an agreed sum insured for specified perils of fire, storm and lightning causing injury or death of livestock. Specialist insurance coverage can be purchased separately to cover high-value stock.

Local transit insurance

This covers loss or damage to farm goods and livestock when being moved short distances in trucks and vehicles.

Public and product liability insurance

This section covers your legal liability to others for personal injury and property damage, plus legal defence costs. It also covers your legal liability to neighbours and others that may arise from your farming activities, such as the escape of fire or collapse of a farm dam, with water damaging the neighbour’s property. Finally, if you grow and sell produce or livestock, this policy will cover your product liability.

Why Choose Farm Insurance?

This is a package of insurance policies specifically designed for farming risks. It is easy to tailor to your own needs, and you can choose from any of the eight sections. You also benefit from reduced admin in only dealing with one insurance policy and getting a package discount.

For advice and assistance, contact your local

Insurance Advisernet adviser today. We are specialists in all types of farming and insurance.