Want to know who needs

professional Indemnity insurance and what’s covered by the policy? Read on and we are going to go into the finer details. In this article you will find out the following:

- Who needs professional indemnity insurance

- Examples of what is covered under professional indemnity insurance policies

- How much professional indemnity insurance do you need

- Special terms and what they mean

If you are a builder or trade contractor and wanting to know about PI insurance specific to your industry then read our article about PI insurance for tradies or design and construction insurance for builders.

So tell us, who needs professional indemnity insurance?

As per the

Australian Government website, “Professional Indemnity insurance helps cover the cost of legal action due to your professional advice or services”.

In its most simplest form, any person or business that is providing any of the following:

- Design services

- Fee for service contractors

- Auditing and compliance companies

- Healthcare and Allied service providers

- Some trade occupations

Some of the most frequent businesses who need professional indemnity insurance include businesses like:

- Accountants

- Architects

- Engineers

- Real estate agents, property managers and values

- Insurance brokers

- Lawyers

- Marketing agencies and IT consultants

- Financial advisors

There are many other businesses that are providing professional services to their clients however, the list above are the most common occupations.

You might be asking why do I need professional indemnity insurance?

There are a number of reasons why you need professional indemnity insurance and in some industries, it’s regulated that you have a policy in place before you get licensed in your profession.

Management Liability insurance is designed to provide protection to both the business and its directors or officers for claims of wrongful acts in the management of the business.

A business insurance pack can provide cover for your business premises and contents, against loss, damage, theft or financial loss from an insured interruption to the business.

Purchase up to six products under one Business Insurance Package.

There are a number of reasons why you need professional indemnity insurance and in some industries, it’s regulated that you have a policy in place before you get licensed in your profession.

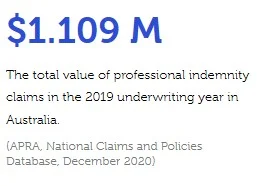

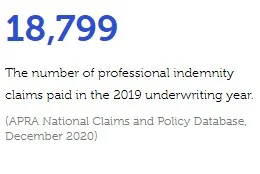

As time has past the need for professional indemnity insurance has become more and more important for business owners as their scope of services become more broad and the litigious nature of customers continues to increase.

A professional indemnity policy is designed to cover you for any act, error or omission that occurs during the operation of your business. This could be as simple as an unintentional privacy breach, omitting information or failure to comply with industry standards or regulations.

The legal costs alone which are generally covered under a PI policy is enough for most people to consider obtaining a policy. Claim costs regardless of whether an allegation is correct or not can cost significant time and money to your business.

What is covered by a professional indemnity insurance policy?

As we touched on above legal costs are one of the main components that are covered by a PI policy. There are however, many other extensions to the cover which included:

- Public relation expenses

- Claim preparation costs

- Court attendance costs

- Loss of documents cover

- Vicarious liability of sun contractors and consultants

As you can see above what is covered by a professional indemnity insurance policy is quite broad. Unlike public liability insurance, PI insurance policies are broadly written to incorporate most aspects that can contribute to any form of financial loss to your client.

What usually isn’t covered by your PI Insurance?

There are a number of exclusions and conditions that arent covered by your PI insurance that you should be aware of. A lot of policies can be different and generally won’t be cover for:

- Commercial liabilities

- Fraud and dishonest acts that are deliberate

- Pollution

- Unpaid fees

PI Claims Examples

Logistics Operator

The Insured, a logistics operator, was storing vaccines in its Cold Room for their client.

A Claim was made against the Insured by their client alleging that there had been a fall in temperature in the Cold Room which was a result of a hardware malfunction, which damaged their products. The Insured notified insurers for their Fire Policy as well as their PI Policy. The Insurers of the Fire Policy indemnified the Insured to the sum of $165,000 which was insufficient to meet the total replacement cost of the vaccines due to a global shortage in certain of those vaccines.

One of the vaccine’s cost had increased from $3.72 to $66.65 per vial. The Claimant sought further damages of $250,000.

Outcome: The Insured appointed panel solicitors to assist with managing the claim against them. The Policy was triggered and paid for defence costs of $15,000. The claim was settled at a mediation for $41,000 which was also indemnified by the Policy.

Payment: $41,000 plus $15,000 in defence costs.

Engineer

An engineering company was appointed to design and certify a roof for an industrial building. After the building was constructed there were strong winds and heavy rainfall to which caused the roof to capsize. Inspections of the structure confirmed that the building was built to the correct specifications provided by the engineer and no portion of liability was allocated to the builder.

The engineer was deemed solely liable for the design not meeting the requested specification and as such a claim was made on the engineers professional indemnity insurance.

Financial Adviser

A financial adviser provided advice to a client in relation to a lump sum investment. The client’s requirements included an investment plan which would provide a certain level of income per year and a minimum risk of capital loss. The adviser recommended investment in a particular fund, which supposedly satisfied the client’s requirements. It turned out that the client did not receive any yearly income but also suffered a capital loss during the two year investment period.

The adviser also failed to provide any updates to the client during the two year investment period regarding the state of his investment. Furthermore, at the time of the original investment, there were clear signs that the fund was starting to perform badly. It was alleged that the fund was of a sophisticated nature that did not suit the client’s needs.

Therefore inappropriate advice was provided. The adviser had few defences to the inevitable claim made against him and the claim was settled out of court for $175,000 (including all costs).

How much professional indemnity insurance do you need?

One of the most important components of your policy is how much you are insured for. Most sub-sections of the policy will have sub-limits that apply and you can usually clearly see what these limits are on your policy however, the overall limit (referred to as limit of indemnity) is the maximum amount that the insurer will pay in the event of any one claim.

Most insurers will also usually provide 1 reinstatement. What this means is that should a claim occur against your business, the reinstatement will be triggered so that you still currently have cover while the claim is going through its motions.

There are a couple of things that you need to consider when you are trying to decide how much professional indemnity insurance do you need and some of these things are:

- Do you have any specific contractual requirements that specify a certain amount you are required to have?

- What type of projects do you work with and what is an average value of these projects?

- What is the average value of your contracts of engagement?

- When was the last time you reviewed this amount?

The worst thing that you can do is not consider any of these things or just let your policy rollover every single year over an extended period. These should be considered every year when your insurance renewal comes due.

As an example, some private institutions require a minimum of $10,000,000 Professional Indemnity insurance per claim to be covered for their projects and between $5,000,000 and $20,000,000

Public Liability Insurance to be in place.

Most Governments, however, require $5,000,000 PI Insurance (South Australia $2,000,000 and Tasmania $10,000,000) for any Government related contract.

These amounts should only be used as a general guide only, don’t just insure that amount because that's what the contract specifies, take the time to consider your level of risk. When working on larger projects it is extremely common for head contractors to pass on their liability under their contract terms leaving consultants and sub-contractors to make up a large portion of the loss that’s covered.

Special terms used in PI policies

All insurance policies can use big fancy words that can be hard to understand. To help you navigate your way through a professional indemnity insurance policy we have given some lay-man terms for some of the common words used on these policies.

Limit of indemnity: This is the limit that you are insured for any one claim

Aggregate Limit: An aggregate limit refers to the reinstatement clause that we listed above. For example, your policy may look like $1,000,000 any one claim and $2,000,000 in the aggregate. This means that you have $1,000,000 covered per any one claim with 1 reinstatement. The aggregate limit is when the full policy then becomes exhausted and no further cover is provided.

Run-off cover: Run-off cover is what you should consider when you stop providing your professional services. Run-off cover allows a policy to remain active in-case a claim arises in future years after your business has ceased trading.

Deductible: A deductible on most other policies is referred to as an excess or a contribution to what you pay when a claim arises.

Costs inclusive: Costs inclusive means the insured must pay the deductible amount towards legal and defence costs.

Costs exclusive: Costs exclusive means that the insured does not need to pay any excess towards legal and defence costs and will only pay the excess amount towards a settlement.

Final Words

This has been a lot to take in however, the most effective way to cover yourself is to understand the policy and the cover that is being provided. With most professional indemnity policies there are a number of insurers that will offer a product online however, most policies will be provided through a Broker. If you are providing advice to your clients then you understand how important it is to get professional advice and the same goes for your insurances. We recommend speaking with an insurance broker to ensure that all aspects are considered when putting a policy in place.

We typically offer a completely free consultation to any new and current clients so if you have any further questions that aren’t listed above, please feel free to

contact us at anytime.