Cyber Liability Insurance for Small Business

Imagine operating a business in 2023 without any technology. It would be unfathomable, right? As much as we like to think we only rely on technology a little, where would many of us be without it? Yes, there are always exceptions to the rule, but in reality, an interruption to a business due to a cyber attack can destroy a business overnight. This begs the question, why are so many business owners not considering cyber liability insurance?

Although we are not cyber security professionals, what we do see is the impact a cyber attack can have on a business. When speaking to experts in the field, the truth is alarming – no one is 100% safe from cyber criminals.

Times Have Changed

Long gone are the days of the geeky teenager in their bedroom trying to hack into a website. Nowadays, cybercriminals are sophisticated and relentless.

They target thousands, if not millions, of individuals and businesses to gain access to their private information. And everyone, we mean everyone, is a potential target.

Here’s the hard truth, in the Annual Cyber Threat Report (2022), the Australian Government Cyber Security Centre (ACSC) witnessed a 13% increase from the previous year in reported cyber crimes, receiving over 76,000 reports.

A common misconception is thinking that cybercrime is mainly related to fraud.

However, many sophisticated cyber criminals use extortion or corporate espionage techniques, wreaking havoc on businesses of all shapes and sizes.

And if you, or your CFO, looked at the financial impact, it would make you nervous (as it should!). For small businesses, cybercrimes cost, on average, $39,000 and $88,000 for medium-sized companies.

Preparation is Key

Before cybercrime buckles you, there are ways to reduce the risks. Firstly speak to a cyber security expert and get your business security audited immediately. This will identify potential exposed back doors and weaknesses in your business.

Also, thorough staff training will help reduce the human element of errors and accidents made by unsuspecting employees.

Another element to consider is insurance, and that’s when you’re in safe hands with us. If your business relies on technology, you shouldn’t just consider cyber liability insurance- it should be a necessity!

Management Liability insurance is designed to provide protection to both the business and its directors or officers for claims of wrongful acts in the management of the business.

A business insurance pack can provide cover for your business premises and contents, against loss, damage, theft or financial loss from an insured interruption to the business.

Purchase up to six products under one Business Insurance Package.

Another element to consider is insurance, and that’s when you’re in safe hands with us. If your business relies on technology, you shouldn’t just consider cyber liability insurance- it should be a necessity!

But what exactly is cyber liability insurance, and how does it work? When is it required, and what does it cover?

In this article, we’ll explore the nature of cyber liability insurance and how it helps you when exposed to a cyber attack.

So, what exactly is cyber insurance? Cyber liability insurance is a type of insurance that provides coverage to businesses for losses incurred due to cyber attacks or data breaches.

It can cover a range of losses including, but not limited to, costs associated with investigating and responding to a data breach, loss of income due to business interruption resulting from a cyber attack, legal fees and regulatory fines, and costs associated with public relations efforts to restore a company’s reputation.

What does a cyber liability insurance policy cover?

Cyber liability insurance can cover losses resulting from the theft of personal information and other cyber crimes. The coverage provided by cyber liability insurance policies can vary depending on policy inclusions and exclusions. Here are some ways it can protect you:

Coverage for data breaches: Covers losses resulting from data breaches, such as stolen personal information, financial loss due to fraud, and costs associated with breach notification and credit monitoring.

Business interruption coverage: Cover business interruption losses resulting from cyber attacks, such as lost income due to a website being down or a system being hacked.

Legal and regulatory expenses coverage: Cover the costs associated with legal fees, regulatory fines, and other expenses incurred due to a data breach.

Reputation protection: Covers the costs associated with public relations efforts to protect the company’s reputation after a data breach.

Risk assessment and mitigation: Cyber liability insurance policies often include risk assessment and mitigation services to help businesses identify potential vulnerabilities and take steps to prevent cyber attacks.

When is cyber insurance required?

If you rely on technology and or handle personal or financial data, your livelihood may be at risk if a cyber attack occurs. The adage “don’t leave it until it’s too late” rings true. The sooner you have coverage, the better. If you don’t fall into this criteria, as it may not be suitable, we still recommend you speak to an insurance broker.

How does cyber liability insurance work?

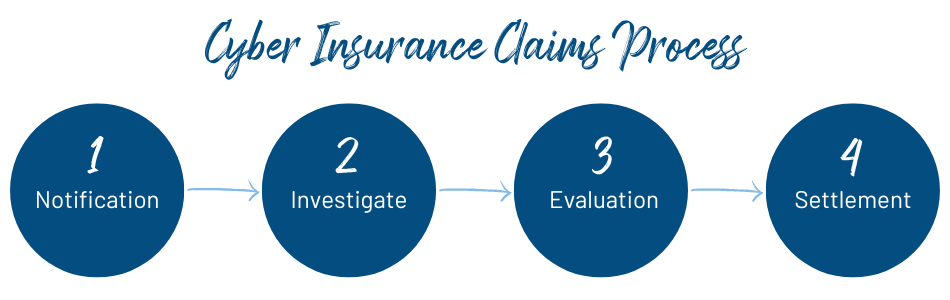

In the unfortunate circumstances that a cyber attack targets you, how does a cyber liability claim work? Here’s how a cyber liability claim typically works:

Step 1 – Notification

Notify your insurance broker immediately after an attack. The report should include details such as the date of the incident, the type of data that was breached, and any potential liability issues.

Step 2 – Investigation

The insurance company will investigate the incident to determine the damage’s scope and the liability’s extent. The investigation may include interviews with the company’s employees, forensic analysis and evaluation of the damages and costs incurred.

Step 3 – Evaluation

Once the investigation is complete, the insurance company will evaluate the claim and determine whether or not it falls within the policy’s coverage. The insurance company would also assess the claim’s value and determine the appropriate compensation.

Step 4 – Settlement

If the claim is approved, the insurance company will work with the insurance broker to reach a settlement that compensates for the damages incurred. The settlement may include reimbursement for legal fees, notification costs, credit monitoring, and any other expenses related to the incident.

It’s important to note that the claims process may vary depending on the insurance policy and the cyber-attack or data breach circumstances.

It’s also essential for you to have a strong understanding of your cyber liability insurance policy to ensure that you will receive the appropriate coverage in the event of an incident. Our insurance brokers can walk you through coverage recommendations if you are uncertain.

How much does cyber liability insurance policies cost?

The cost of cyber liability insurance can vary due to several factors. These factors include; the size and type of your business, the industry, the level of risk involved, and the amount of coverage needed.

Business size: The size of your business can affect the cost of the policy. Larger companies with more customers and data may require more coverage, resulting in higher premiums.

Type of industry: Certain industries may be at higher risk for cyber-attacks, which can affect the cost of the policy. For example, a financial institution may require more coverage than a small retail business.

Security measures: The level of security measures in place can also affect the cost of the policy. A business that has invested in solid cybersecurity measures, such as firewalls, encryption, and regular employee training, may qualify for lower premiums.

Policy coverage: The level of coverage and the policy’s limits can affect the policy’s cost. A policy with higher limits or more comprehensive coverage may result in higher premiums.

As a result, it’s challenging to provide a general estimate of the cost of cyber liability insurance. However, small businesses with less than $1 million in revenue may pay around $1,500 per year for basic coverage.

In contrast, larger companies may spend tens of thousands yearly for more comprehensive coverage. It’s important to note that you can work with your insurance broker to customise a policy that meets your needs and budget.

Do you need cyber liability insurance?

If you still need to decide if you need

cyber liability insurance or would like to get a quote for your business today, call one of our

business insurance brokers. We can give you risk advice so you have the information you need to make an informed decision.