As a business owner, you may wonder what are the most common claims among Aussie businesses? Our

brokers speak to business owners daily, and we’ve noticed that some business insurance claims arise more often than others. Here are some of our top claims and ways to avoid them. Let’s begin with one of the essential factors in a business: your employees.

Employee Injuries

Accidents and injuries are an unfortunate occurrence in any business. The toll on the employee and the cost to the employer can be astronomical.

During 2020-2021, Safe Work Australia reported over 130,000 serious claims with a medium-time loss of seven working weeks, costing on average $15,072. The top three leading causes of claims were body stressing* (37%), falls, trips and slips (23%) and being hit by moving objects (16%).

Labourers were the top occupation rate with employee injuries. They had the highest frequency of serious incidents, with almost twenty-two claims per million hours worked.

However, reducing employee risks is possible. It can begin with setting safety as a priority in the work culture. As the employer, you must provide proper training, implement safety protocols, and maintain a safe work environment to prevent and reduce employee injury.

Property Damage

Property damage is another common business insurance claim our brokers see. Damage to your property can occur in several ways, typically due to fire, natural disasters, theft, or vandalism. If you are like more business owners, you would have witnessed the impact of fire, flooding, and other natural disasters over the past few years.

Due to the La Nina weather pattern, our team has assisted with hundreds of storm and flood claims over the past two years. To help reduce the impact of natural disasters, it is essential that you have a detailed disaster recovery plan. Also regularly inspecting and maintaining your property to identify potential hazards is critical.

Another type of growing property damage is intentional theft and vandalism. By improving your security measures, you can dramatically decrease your business being targeted by thieves and vandals.

Enhancing security measures such as security fencing, cameras, lighting and controlled access will reduce the risk. We recommend conducting personnel checks as preventative measures to identify high-risk employees.

Before hiring, check criminal records and find out about their employment history, education and background so that you make an informed decision.

Agile CyberCare covers small businesses against cyber threats and data breaches, including 24/7 emergency response for incidents.

Cyber Liability Insurance is designed to help protect you from claims and support your profitability in the event of a cyber breach or attack.

Agile CyberSelect is aimed at mid-market to corporate clients and is a comprehensive Cyber Insurance policy with 16 policy benefits and 24/7 incident response.

Before hiring, check criminal records and find out about their employment history, education and background so that you make an informed decision.

Public Liability

This type of insurance helps you cover legal costs and compensation payments that you may be required to pay if a third party suffers injury or property damage due to the business’s negligence.

Public liability insurance covers personal injury or property damage on your business’s premises, as well as injury or damage that arises off-site but is caused by the business’s activities, products or services. There are several ways to reduce these public liability claims, including:

- Regular risk assessments: Identifying potential hazards on your premises and take steps to eliminate or reduce them.

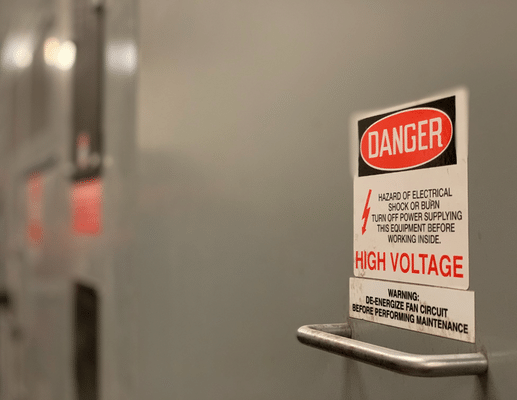

- Maintaining your premises and equipment: This will ensure that your premises equipment is in good working order and will avoid unnecessary mishaps.

- Providing clear warnings and instructions: For any hazards that cannot be eliminated, installing warning signs, barriers, or instructions on how to use equipment or products safely will reduce injury to visitors or customers.

Product Liability

Product liability insurance covers claims made by third parties for injury or property damage that is caused by a product sold, supplied, or manufactured by your business. This can include claims arising from product defects, design flaws, or inadequate warnings or instructions.

Here are some tips to avoid product liability claims:

- Conduct product testing and quality control

- Provide clear and comprehensive warnings and instructions

- Monitor and address product safety concerns

- Train employees and vendors

- Maintain records

Although it is not necessarily a legal requirement for businesses to have public and product liability insurance, we strongly recommend this type of insurance to our clients. Without this type of insurance, you could be up for significant compensation payments and legal costs, which could be financially devastating.

Additionally, many clients and customers require proof of public and product liability insurance before doing business with your company.

Cyber Liability

As technology advances in business, we are seeing greater carnage from cyber attacks on businesses of all sizes. If you are among the many business owners with growing concerns about the impact of cyber attacks, you are certainly not alone.

We can all agree that to maintain a competitive advantage, we increasingly rely on technology, which results in a potential increase in data breaches and financial loss. To avoid this, we recommend investing in tough cybersecurity measures, regularly updating your software, and educating your employees on identifying and avoiding phishing scams.

What to do next

Overall, the best way for you to avoid business

insurance claims is to implement risk management strategies for aspects of your business. Additionally, it is crucial to have adequate insurance coverage that meets your business’s unique needs to protect against unforeseen events that could cause financial loss.

If you would like to discuss potential risks to your business and receive your free risk report contact us today.

*Body stressing is a collective term covering a broad range of health problems associated with repetitive and strenuous work. Typical body stressing injuries that occur at the workplace (commonly known as musculoskeletal disorders) include strains and sprains, back or neck injuries, and tendonitis/tenosynovitis.