Risk. That four-letter word that strikes fear in the hearts of businesses‚ or, on the flip-side, a sense of steely resolve and frank excitement for companies who are well-equipped to respond to any situation.

For businesses smart enough to think ahead and exercise their foresight with proper coverage, a risk isn't scary. It's controlled. That's precisely what small business insurance, when done right, can do. The right insurance will:

- Manage risk

- Protect a business

- Support a business during times of critical expansion and growth

What is a small business?

The term 'small business' covers a whole host of business formats and types of operations in a range of diverse industries. Just think about it: a family business, a drop-shipping business and lean marketing agencies are all considered small businesses. In other words, 'small business' is not a one-size-fits-all.

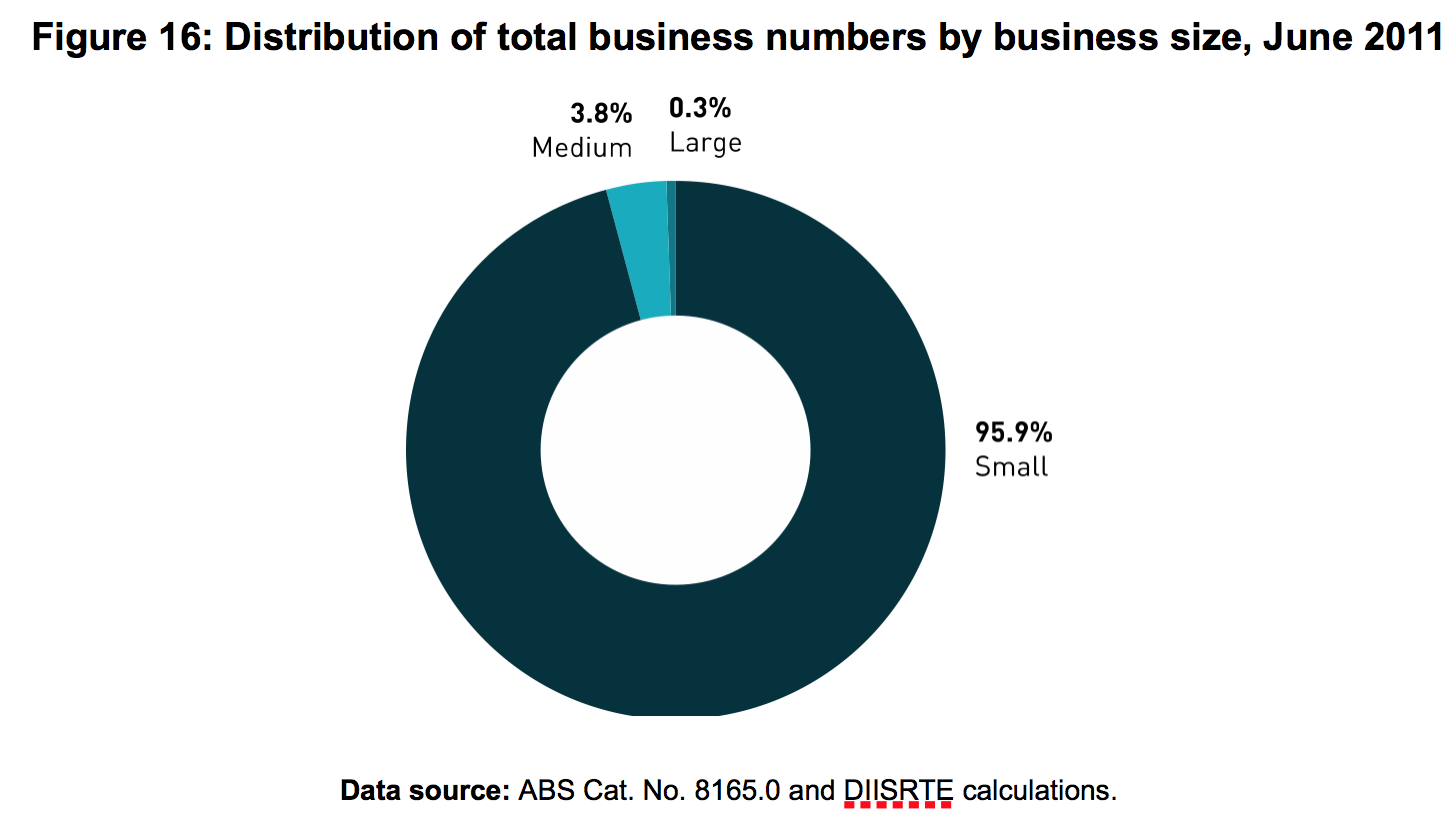

'There is no 'typical' small business. It is a very diverse sector, covering many different types of business activity. The vast majority (over nine in ten) of Australian businesses are small businesses. They account for 33% of Australia's GDP, employ over 40% of Australia's workforce, and pay around 12% of total company tax revenue'Kate Carnell, AO Australian Small Business and Family Enterprise Ombudsman

So, it's fitting that insurance policies vary to suit and serve their businesses needs. In Australia alone, small businesses are the most popular format and they're on the rise. Small businesses can be defined as those

employing anywhere from one to 19 people.

A business insurance pack can provide cover for your business premises and contents, against loss, damage, theft or financial loss from an insured interruption to the business.

Public Liability insurance is there to provide protection if someone makes a claim against the insured, the business or its employees.

Professional Indemnity insurance is designed for professionals who provide a specialist service or advice, providing protection for financial loss and legal costs of a claim.

What can small business insurance cover?

To get from surviving to thriving, small businesses need to think through a plan of action. This includes planning for the unexpected.

Small business insurance is exactly what it sounds like: An insurance policy that is tailored specifically to cover small businesses in various niches and industries to protect their assets, their employees, both internally and externally, as well as against legal liabilities.

While products do vary, there are two compulsory forms of business insurance:

- Workers' compensation: Varying by state and territory, workers' compensation protects employees in the event of an accident or sickness.

- Compulsory third party: Again, each of the states and territories has their own CTP but, generally speaking, this is car insurance which covers individuals operating a vehicle for claims made against the individuals, in the event that personal injuries occur from the use of a car.

Furthermore, home-based businesses have their own set of needs, besides the two listed above, including:

- Public liability

- Equipment insurance

- Fire, storm and theft

- Business interruption insurance

- Insurance policies taken out for loss of income due to accident or illness

What might small business insurance leave out?

There are many aspects of small business insurance that are 'optional', in the sense that they only apply to particular businesses or types of situations that are likely to occur. These policies, however, are quite common and focus on protecting the assets, revenue, liabilities and employees. A few examples include:

- Property insurance

- Product liability insurance

- Tax audit insurance

- Insurance for deterioration of stock

- Machinery & equipment breakdown insurance

- Goods in transit/property in transit insurance

- Computer and electronic equipment insurance

Why can insurance brokers help you find the right small business insurance policy for you?

Finding a quote for an insurance policy that broadly matches your business is one thing. Finding a quote for a policy that covers everything that is essential without breaking the bank, is a different animal altogether.

Finding insurance can be quite a confusing, tedious and time-consuming task. Insurance Brokers form an invaluable link from small businesses to the insurance company, bringing both sides into a mutually beneficial package. They can use their expertise and knowledge about a client's business to find matching policies and bundles that would serve the business best.

It's the job of a broker to choose providers and companies that specialise in or have knowledge about the industry the business operates in. An insurance broker's connections and past experience with insurance providers will often also net businesses access to a 'deal' or insurance policy that may not have otherwise been available to them.

Industries that need small business insurance

Small business insurance policies can cover all sorts of industries‚ from our most foundational to the most unexpected. For example, while farms, restaurants and accounting firms are all relatively standard and common small businesses that call for insurance, have you ever thought about backpacker hostels, food trucks, nightclub venues and 24-hour convenience stores? These are less-frequently considered small business formats that call for insurance and their own specialised policy needs.