Do you currently look after insurance in your business? Whether you DIY or use an insurance broker, you may wonder which option is right for you? In this article, we’ll explore the advantages and disadvantages of both DIY vs. Insurance Brokers. To make this a fair playing field, we’ll consider the essential features of insurance including price, efficiency, communication, claims and renewals.

Price

The first obvious mistake we see many business owners make is basing their decisions on price alone. Yes, we agree that pricing can be a primary factor to insurance-related decisions. However, are you potentially harming your long-term future to save a few dollars a month on premiums?

One of the most common statements we hear is “I have no idea how much it would cost to insure my business”. Finding out how much it costs to insure your business, especially when starting a business, can be daunting. It can also be a significant reason why people choose to buy insurance directly from an insurer.

Many fear that using a broker will be more expensive – and this is a myth. You can eliminate the potential harm of being underinsured by having a professional broker assess your business.

We advise that unless you can

answer these questions, you should be considering contacting an insurance broker. After all, you use a lawyer for legal matters, or an accountant to take care of your financials, so why wouldn’t you use an insurance broker for your insurance needs?

_____________________________________________________________

"After all, you use a lawyer for legal matters, or an accountant to take care of your financials, so why wouldn’t you use an insurance broker for your insurance needs?"

_____________________________________________________________

Our favourite saying is “you get what you paid for” as this applies to insurance. If you find your insurance is cheaper than expected, it may be too good to be true. So make sure you have the right policy type and the coverage amount.

Insurance brokers prices may vary compared to what is found online because they make detailed assessments. If you’re looking for value for money, insurance brokers can also get access to rates that may not be available to the public.

Advantages & Disadvantages of DIY vs. Insurance Brokers

DIY Pros – You can save you money on premiums in the short-term.

DIY Cons – You could be at greater risk of not having the right insurance or being underinsured.

Management Liability insurance is designed to provide protection to both the business and its directors or officers for claims of wrongful acts in the management of the business.

A business insurance pack can provide cover for your business premises and contents, against loss, damage, theft or financial loss from an insured interruption to the business.

Purchase up to six products under one Business Insurance Package.

DIY Cons – You could be at greater risk of not having the right insurance or being underinsured.

Insurance Broker Pros – They can provide you with the right insurance policies and protect you for the right coverage amount, saving you money in the long-term

Insurance Broker Cons – You will need to pay a small commission to the broker, which is a service fee for the work they do on your behalf.

Efficiency

How many hats do you wear in your business? It’s not unusual to see business owners doing multiple roles in the workplace. And this means one thing – they don’t have much time on their hands!

Nowadays, it’s easy to jump on a comparison website, throw in a few key details and figures. Then BAM! Your insurance answers are solved!

If only it were that easy.

There’s a reason why insurance companies try to make it look easy. It’s almost like doing a job interview. Imagine meeting the candidate for 30 seconds and saying “You’ve got the job!” before even looking at their resume. Choosing the right insurance should not be a decision that is made in less time than it takes to make a cup of coffee.

_____________________________________________________________

"Choosing the right insurance should not be a decision that is made in less time than it takes to make a cup of coffee."

_____________________________________________________________

Would you like to know the secret to efficiency?

Delegation.

Yes, good old delegation can be your best friend for a time-poor business owner. By delegating your insurance to a broker, you’re saving time when purchasing insurance and also when you’ve got to make a claim.

But don’t get us wrong, if you precisely know what insurance you need, then buying directly from an insurer can be efficient.

Advantages & Disadvantages of DIY vs. Insurance Brokers

DIY Pros – Easy access to online quotes and insurance comparison websites means you get fast coverage.

DIY Cons – If you don’t know what insurance you need, you may find the recommended policies on the websites may not be suitable for your circumstances.

Insurance Broker Pros – Call an insurance broker, and they will do the rest for you. Now that’s what I call efficient! No second-guessing yourself and feel relieved knowing that a professional is taking care of you.

Insurance Broker Cons – It may take slightly longer to get coverage as the broker will need to find out more about your needs and provide options for you to make your decision.

Communication

Do you hate being on hold when trying to contact a large company? How about feeling relieved when you hear the automated voice saying “your call is important to us”.

Don’t kid yourself.

If that doesn’t grind your gears, I applaud you.

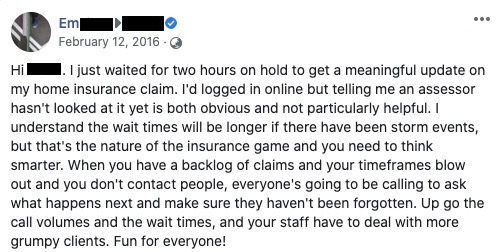

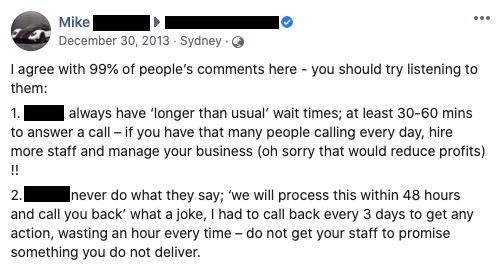

For the rest of us, this can be one of the most frustrating, time-consuming tasks that we try to avoid. And you’re not alone. Below are some typical comments online when it comes to customers and calls wait times:

Can you feel their frustration? You don’t want to be in their position.

When insurance companies face an increase in call traffic, their call wait times also increases. That’s when you’ve got two choices, waste a day or two on hold or get a broker to do it for you! Fortunately, brokers can be extremely patient people.

There’s also another side to communication you need to consider if you want to DIY your insurance. Usually, when dealing with an insurer directly, you won’t have a dedicated account manager who will be there to answer your call or reply to your emails. That’s when you get passed around departments, and you start feeling like another number.

This is a massive point of difference because normally brokers have a dedicated account manager. Here at Macey’s, our brokers know you personally and care about what you’re going through.

If you don’t mind who handles your claim, then, by all means, buy your insurance direct! However, business owners choose a broker as they want to have a trusted relationship they can depend on.

Advantages & Disadvantages of DIY vs. Insurance Brokers

DIY Pros – To be honest, there aren’t many pros that come to mind when you think of insurance companies

DIY Cons – Where to begin? Unless you like anonymity, then you’ll have to face long call wait times and being passed around departments.

Insurance Brokers Pros – They actually care about you and your business’ needs. Their reputation hangs on the quality of relationship and consideration they have for their clients.

Insurance Brokers Cons – It’s hard to fault someone whos willing to call the insurance company on your behalf.

Claims

When you have to make a

claim, it can be a stressful time. Those premiums that you pay annually can pay off when you have a claim to make . For many, this is a lifesaver to their business.

The claims process can be drawn-out and extremely confusing. Depending on the nature of the claim, it can take months to resolve.

These days, if you’re dealing directly with an insurer, some have the ability to submit claims online. Some insurers even have mobile apps that allow you to take images and write details about the claim.

It’s a similar process when dealing with an insurance broker. However, if you’re not tech-savvy, you can quickly contact them to begin the claims process.

Things get messy when your claim is getting assessed. With an insurance broker, they will go over your claim before submitting it to the insurance company. But when you DIY, you may not be aware of exclusions that may prevent you from claiming.

Also, depending on the claim, there may be assessors, contractors and other parties involved in the claims process. If you have the time and energy, you will be able to persist with a claim until its completion. If you find yourself confused, this is when an insurance broker will be there to do it on your behalf.

Don’t forget that negotiations are a part of this process. So if you’re not happy with the outcome, a broker will be able to try and negotiate a better result.

Advantages & Disadvantages of DIY vs. Insurance Brokers

DIY Pro – Access to online claims portal or app to start the claims super quickly.

DIY Cons – Having to navigate the claims process alone and being uncertain about how to get the best outcome for yourself.

Insurance Broker Pros – Their ability to handle the whole claims process on your behalf

Insurance Broker Cons – No snazzy online portal or app, but you get to talk to a real human when submitting a claim.

Renewals

Congratulations on getting this far! When it comes to renewals, it’s an opportunity for reflection. By looking back on the past 12 months of business, you can see for yourself the highlights and challenges that you faced. You then can adjust your insurance needs so your covered for the next 12 months.

Many have found that when you deal with an insurer directly is like being on autopilot – seamless and automated. This can be great if you’re busy and have not had any changes in your business in the past twelve months. The insurer will notify you when your renewal is coming, and they generate a new policy and premium. But what if things have changed, or will change in the next twelve months?

That’s why you should assess your insurance needs every year. We’ve heard horror stories about businesses failing to report a new capital purchase and forgot to add it to their policy then disaster strikes and they’re out of pocket.

When you have an insurance broker, they will ask questions about your business to make sure there are no gaps in your policies. So, rest assured knowing that you’re covered as your business grows and evolves.

Advantages & Disadvantages of DIY vs. Insurance Brokers

DIY Pros – Easy and fast renewals for those with no changes to the business

DIY Cons – You may have gaps in your insurance where you have forgotten to report changes to your business and maybe underinsured.

Insurance Broker Pros – Before the renewal, they will contact you ask questions about the current state of business and reassess your insurance requirements, so you have the right insurance.

Insurance Broker Cons – It may take a little effort on your behalf gathering information so you can declare accurate information

Let us help you

We hope this article has brought you more clarity surrounding the differences between doing insurance yourself, compared to having a business insurance broker to it for you. As you can see, there can be advantages and disadvantages for each, which is why you need to carefully consider each option to make sure it suits your circumstances.

If you would like more information about how an insurance broker can help your business, we’re here to answer any questions you may have.